The global Ultomiris drug market is poised for substantial growth over the coming decade, reflecting strong momentum in the treatment landscape for rare complement-mediated disorders.

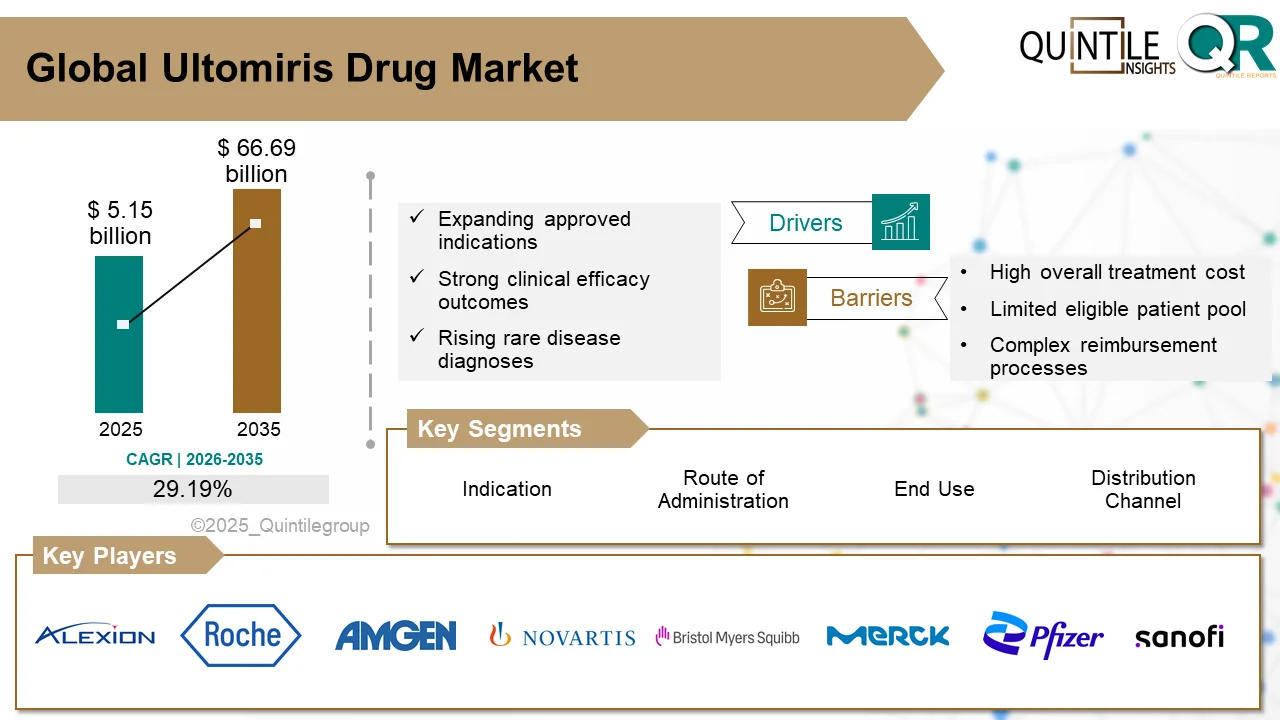

According to recent market analysis, the market is estimated at USD 5.15 billion in 2026 and is projected to reach USD 66.69 billion by 2035, registering a robust compound annual growth rate (CAGR) of 29.19% during the forecast period.

Ultomiris, developed by Alexion Pharmaceuticals, a subsidiary of AstraZeneca, is a long-acting C5 complement inhibitor containing the active substance ravulizumab. The drug is approved for the treatment of several rare autoimmune and complement-mediated conditions, including paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), generalized myasthenia gravis (gMG), and neuromyelitis optica spectrum disorder (NMOSD). By inhibiting complement system overactivation, Ultomiris helps prevent immune-mediated damage to blood cells and vital organs.

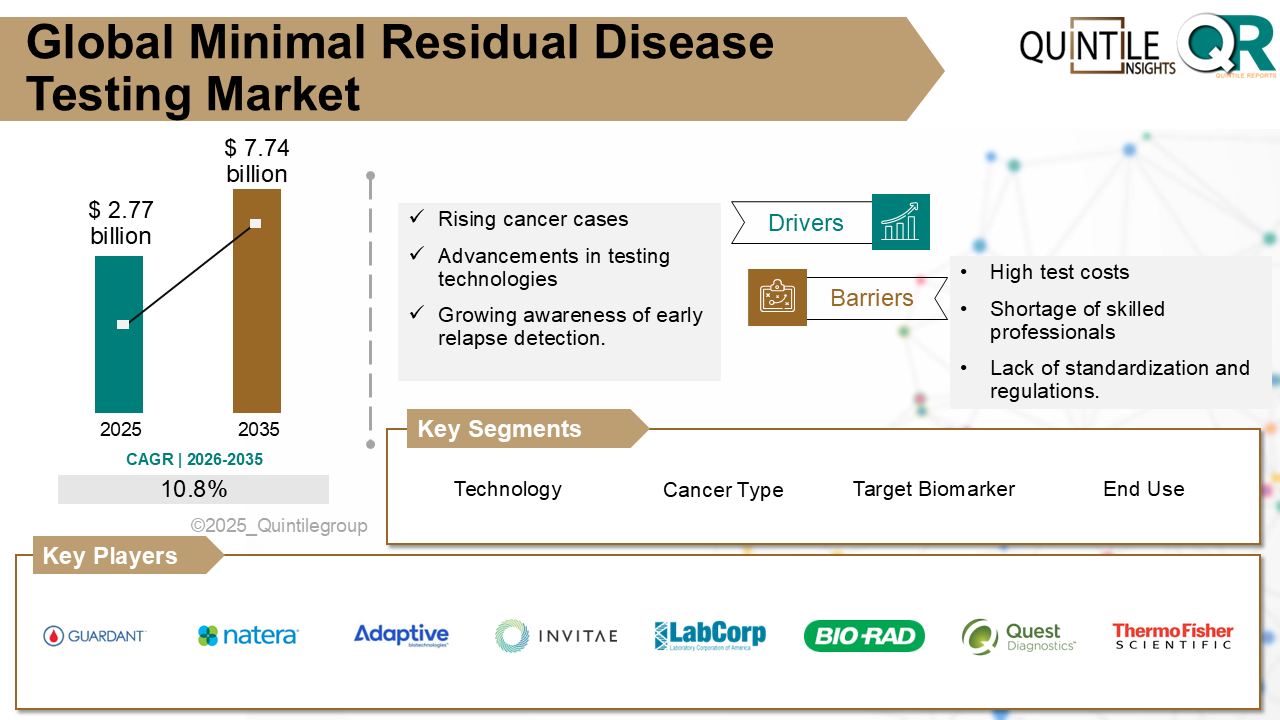

One of the primary factors driving market expansion is the increasing incidence and improved diagnosis of rare complement-related disorders. Enhanced disease awareness among healthcare professionals and advancements in diagnostic technologies have resulted in earlier and more accurate identification of eligible patients. As a result, demand for targeted biologic therapies such as Ultomiris continues to rise globally.

Another significant growth catalyst is Ultomiris’ extended dosing schedule. Compared to its predecessor, Soliris (eculizumab), Ultomiris requires administration every eight weeks after initial loading doses, substantially reducing treatment burden. This longer dosing interval improves patient adherence and quality of life, while also supporting physician preference for long-acting therapeutic options in chronic disease management.

Request Sample PDF Report: https://www.quintilereports.com/request-sample/1094-ultomiris-drug-market/

Regulatory milestones have further strengthened the drug’s commercial trajectory. In March 2024, the U.S. Food and Drug Administration approved Ultomiris for adults with anti-AQP4 antibody-positive NMOSD, marking the first long-acting C5 inhibitor available for this indication. The approval was supported by Phase III clinical data demonstrating a 98.6% reduction in relapse risk. Additional regulatory approvals in markets such as Canada, Europe, and Japan have expanded the eligible patient pool and reinforced the drug’s global presence.

Special Discount: https://www.quintilereports.com/request-discount/1094-ultomiris-drug-market/

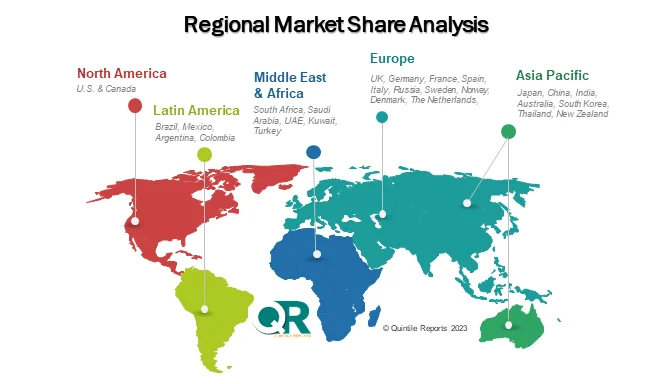

Regionally, North America remains the largest market, driven by high disease awareness, favorable reimbursement frameworks, and early regulatory approvals. Europe follows with steady uptake, supported by structured healthcare systems and inclusion in rare disease treatment guidelines. Meanwhile, Asia Pacific is witnessing rising adoption, particularly in Japan and other developed healthcare markets, although cost barriers continue to limit broader penetration in lower-income countries.

Despite its strong growth outlook, the Ultomiris market faces several challenges. The high cost of biologic therapies remains a major barrier, especially in emerging economies with limited reimbursement infrastructure. Additionally, the patient population for approved indications remains relatively small due to the rarity of the underlying diseases. Increasing competition from biosimilars and alternative complement inhibitors under development may also intensify pricing pressures in the coming years.

Buying Now: https://www.quintilereports.com/request-enquiry/1094-ultomiris-drug-market/

The competitive landscape includes major global pharmaceutical companies such as Roche Holding AG, Novartis AG, Pfizer Inc., and Johnson & Johnson, among others. However, Ultomiris benefits from orphan drug exclusivity and strong patent protection, positioning it favorably against near-term direct competition.

Looking ahead, sustained investments in research and development, expansion into additional indications, and strategic partnerships are expected to further solidify Ultomiris’ market leadership. As healthcare systems increasingly prioritize innovative therapies for rare diseases, the global Ultomiris drug market is anticipated to maintain its upward trajectory through 2035, offering significant opportunities for stakeholders across the pharmaceutical value chain.

Quintile Research concludes that while pricing and accessibility remain key considerations, the combination of clinical efficacy, extended dosing convenience, and expanding regulatory approvals will continue to drive strong long-term growth in the Ultomiris drug market worldwide.

1. What is Ultomiris and what conditions does it treat?

Ultomiris (ravulizumab) is a long-acting C5 complement inhibitor developed by Alexion Pharmaceuticals, a subsidiary of AstraZeneca. It is approved for the treatment of rare complement-mediated disorders including:

-

Paroxysmal Nocturnal Hemoglobinuria (PNH)

-

Atypical Hemolytic Uremic Syndrome (aHUS)

-

Generalized Myasthenia Gravis (gMG)

-

Neuromyelitis Optica Spectrum Disorder (NMOSD)

It works by inhibiting overactivation of the complement system, thereby preventing immune-mediated damage.

2. What is the projected growth of the Ultomiris drug market?

The global Ultomiris drug market is estimated at USD 5.15 billion in 2026 and is projected to reach USD 66.69 billion by 2035, growing at a CAGR of 29.19% during the forecast period.

3. What are the major drivers of the Ultomiris drug market?

Key growth drivers include:

-

Rising diagnosis of rare complement-mediated disorders

-

Expanding regulatory approvals across multiple indications

-

Extended 8-week dosing schedule compared to older therapies

-

Strong reimbursement frameworks in developed markets

-

Ongoing clinical trials and R&D investments

4. Why is Ultomiris preferred over Soliris?

Ultomiris offers an extended dosing schedule of every eight weeks compared to the biweekly dosing of Soliris (eculizumab). This significantly reduces treatment burden, improves patient adherence, and enhances quality of life. Its strong clinical data across multiple indications further supports physician preference.

5. Which region dominates the Ultomiris drug market?

North America, particularly the United States, leads the global market due to:

-

Early regulatory approvals

-

High disease awareness

-

Advanced healthcare infrastructure

-

Strong insurance and reimbursement support

Europe and Japan also represent significant revenue-generating markets.

6. What challenges does the Ultomiris market face?

Major challenges include:

-

High treatment costs limiting affordability in emerging economies

-

Small patient population due to rare disease focus

-

Growing competition from biosimilars and alternative complement inhibitors

-

Regulatory scrutiny regarding long-term safety and pricing

7. Who are the key competitors in the Ultomiris drug market?

Key players operating in the broader rare disease and complement inhibitor space include:

-

Pfizer Inc.

-

Johnson & Johnson

-

Sanofi S.A.

However, Ultomiris benefits from orphan drug exclusivity and patent protection.

8. What was a recent major regulatory development for Ultomiris?

In March 2024, the U.S. FDA approved Ultomiris for adult patients with anti-AQP4 antibody-positive NMOSD, making it the first long-acting C5 inhibitor approved for this indication.

9. What distribution channels are covered in the report?

The report segments distribution channels into:

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

Hospital pharmacies currently account for the largest share due to intravenous administration requirements.

10. What does the Ultomiris Drug Market report include?

The report provides:

-

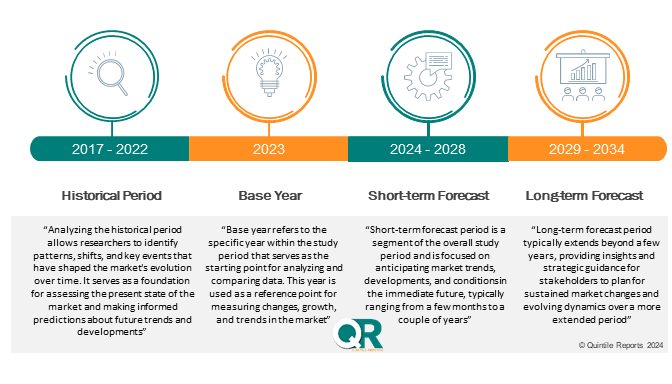

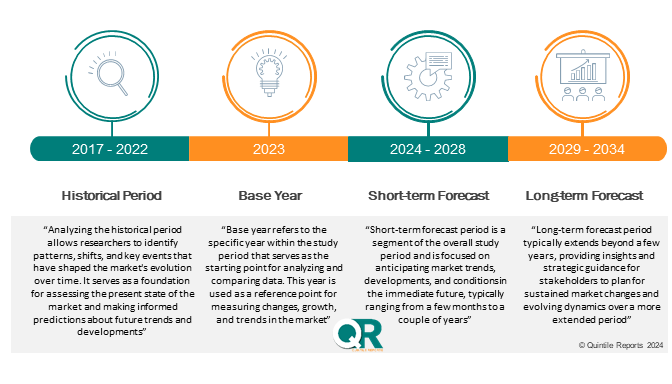

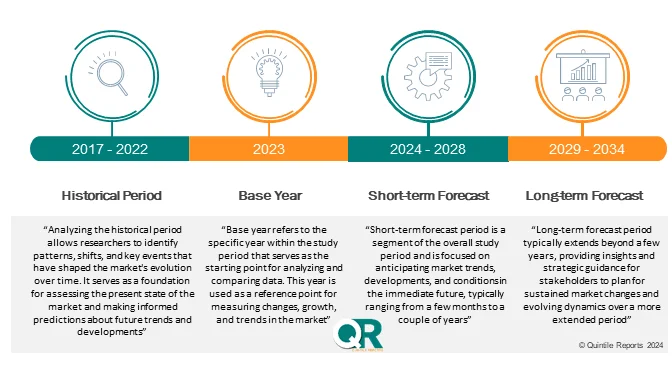

Historical analysis (2017–2024)

-

Market forecasts (2026–2035)

-

CAGR analysis

-

Segment-wise insights

-

Regional and country-level breakdown

-

Competitive landscape and company profiling

-

Market drivers, restraints, and opportunity analysis

Our Latest Publication

Ultomiris Drug Market (2026 – 2035)

Our Latest News:

Aquatic Feed Market Set for Robust Growth Through 2032, Driven by Innovation and Rising Aquaculture Demand

Adarsh

Business Strategy — Quintile Reports

Adarsh is a Business Strategy professional focused on transforming market insights into actionable growth plans. He supports strategic initiatives through market analysis, competitive intelligence, and data-driven decision-making to help drive long-term business success.

His core skills include strategic planning, market research, growth opportunity assessment, trend analysis, performance tracking, stakeholder communication, cross-functional collaboration, and critical problem-solving.