The global industrial motor market is poised for steady expansion over the next decade, supported by accelerating industrial automation, rising energy efficiency standards, and expanding infrastructure investments worldwide.

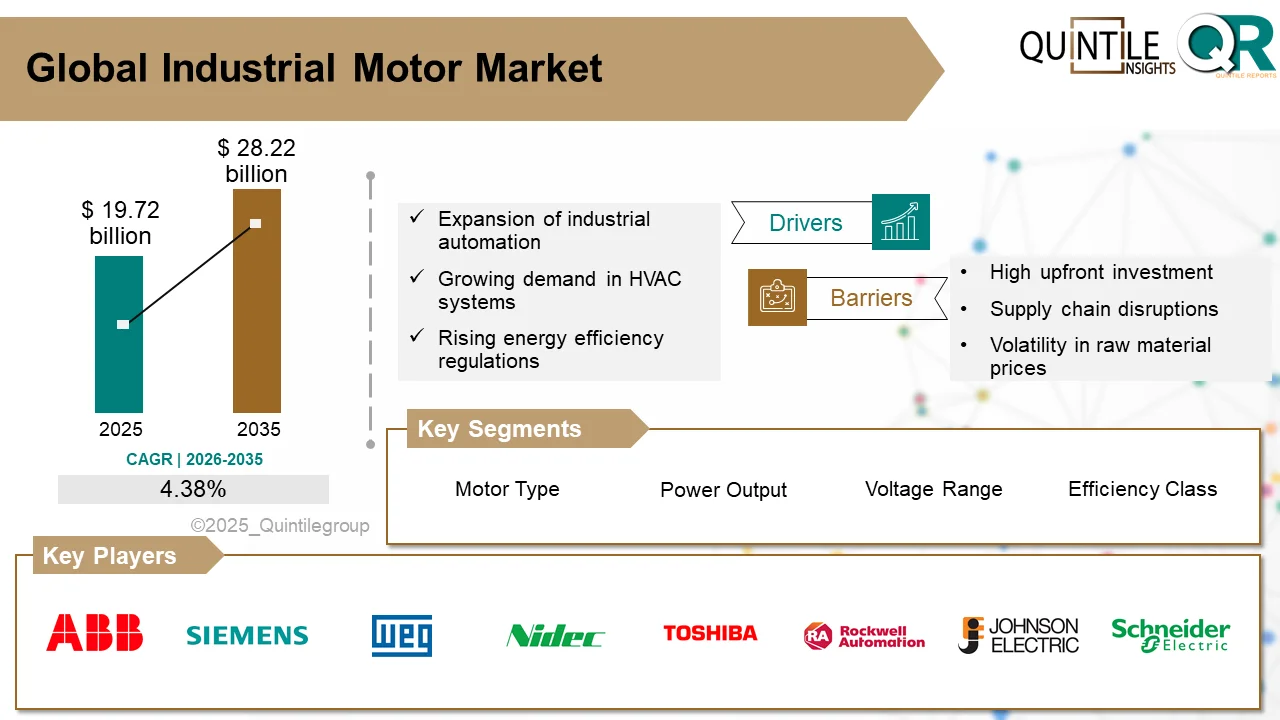

According to the latest study by Quintile Research, the market was valued at USD 19.72 billion in 2025 and is projected to reach USD 28.22 billion by 2035, registering a compound annual growth rate (CAGR) of 4.38% during the forecast period from 2026 to 2035.

Industrial motors serve as the backbone of modern industry, powering a broad spectrum of equipment across manufacturing, oil & gas, power generation, water treatment, mining, construction, automotive, and HVAC sectors. As global industries modernize operations and transition toward smart manufacturing ecosystems, demand for advanced motor technologies continues to grow.

Request Sample PDF Report:- https://www.quintilereports.com/request-sample/1223-industrial-motor-market/

Market Growth Driven by Automation and Electrification

One of the primary growth drivers is the rapid integration of automation technologies across industrial environments. Smart factories, robotics, automated material handling systems, and digitally controlled production lines rely heavily on high-performance motors such as AC motors, DC motors, servo motors, stepper motors, synchronous motors, and induction motors.

Special Offers:- https://www.quintilereports.com/request-discount/1223-industrial-motor-market/

The transition toward Industry 4.0 is significantly influencing purchasing patterns, with manufacturers prioritizing motors that offer high precision, durability, and seamless integration with digital control systems. The adoption of predictive maintenance technologies and IoT-enabled motor monitoring systems is further enhancing operational efficiency while reducing downtime.

In addition, electrification across transportation, renewable energy installations, and electric vehicle (EV) production facilities is generating new demand avenues. Industrial motors are widely used in wind turbines, battery manufacturing units, EV assembly lines, and energy storage systems, reinforcing long-term market expansion.

Order Now:- https://www.quintilereports.com/request-enquiry/1223-industrial-motor-market/

Energy Efficiency Regulations Supporting Demand

Energy efficiency standards continue to play a critical role in shaping market trends. Governments worldwide are implementing stringent regulations to reduce industrial energy consumption and carbon emissions. Efficiency classes such as IE1, IE2, IE3, and IE4 & above are increasingly influencing procurement decisions, with industries favoring high-efficiency motors to lower operational costs and meet compliance standards.

The rising emphasis on sustainable manufacturing and green industrial practices is encouraging investments in premium-efficiency motors, particularly in developed markets across North America and Europe.

Regional Outlook

Asia-Pacific is expected to emerge as the fastest-growing regional market, driven by rapid industrialization in China, India, Japan, and South Korea. Expanding manufacturing bases, infrastructure development, and rising automation adoption are fueling consistent demand.

North America remains a mature yet stable market, supported by manufacturing modernization, automation upgrades, and strong compliance frameworks. Europe is witnessing steady growth due to sustainability mandates and advanced engineering capabilities, particularly in automotive and renewable energy sectors.

Meanwhile, Latin America and the Middle East & Africa are experiencing moderate growth, largely supported by mining, oil & gas, construction, and infrastructure projects.

Competitive Landscape

The industrial motor market is highly competitive and characterized by the presence of global manufacturers focusing on innovation, product differentiation, and strategic collaborations. Leading companies operating in the market include ABB, Siemens AG, WEG SA, Nidec Corporation, Toshiba Corporation, Rockwell Automation Inc., Schneider Electric, General Electric, and Mitsubishi Electric Corporation, among others.

These players are actively investing in research and development to enhance product efficiency, improve reliability, and integrate digital intelligence capabilities into their motor offerings. Mergers, acquisitions, and strategic partnerships remain key growth strategies across the industry.

Outlook Through 2035

Looking ahead, sustained investments in industrial infrastructure, renewable energy projects, smart manufacturing systems, and automation technologies are expected to maintain strong growth momentum. Companies that align with evolving efficiency standards, digital transformation initiatives, and customer-specific application requirements will be well-positioned to capitalize on emerging opportunities.

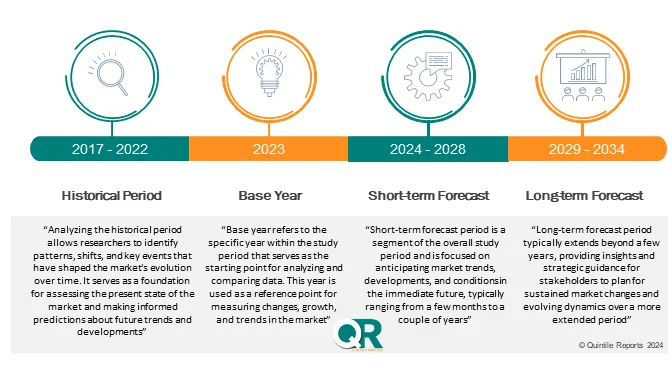

With comprehensive historical analysis from 2017 to 2024 and forward-looking projections through 2035, Quintile Research highlights that the industrial motor market will continue to play a central role in global industrial development, supporting productivity, sustainability, and technological advancement across sectors.

1. What is the current size of the global Industrial Motor Market?

According to Quintile Research, the global industrial motor market was valued at USD 19.72 billion in 2025 and is projected to reach USD 28.22 billion by 2035, growing at a CAGR of 4.38% during the forecast period (2026–2035).

2. What factors are driving the growth of the Industrial Motor Market?

Key growth drivers include:

-

Rapid adoption of industrial automation and robotics

-

Expansion of smart manufacturing under Industry 4.0

-

Growing demand for energy-efficient motors (IE3, IE4 & above)

-

Rising investments in renewable energy and electric vehicle production

-

Infrastructure development and industrial expansion in emerging economies

3. Which motor types are covered in the report?

The report segments the market by motor type into:

-

AC Motors

-

DC Motors

-

Stepper Motors

-

Servo Motors

-

Synchronous Motors

-

Induction Motors

Among these, AC and induction motors hold significant market share due to widespread use in manufacturing and heavy industries.

4. Which regions are expected to witness the highest growth?

The Asia-Pacific region is projected to grow at the fastest rate due to rapid industrialization in China, India, Japan, and South Korea.

North America and Europe remain mature markets driven by modernization initiatives and strict energy-efficiency regulations, while Latin America and the Middle East & Africa are experiencing steady growth supported by infrastructure and energy sector investments.

5. Who are the major players operating in the Industrial Motor Market?

Key companies profiled in the report include ABB, Siemens AG, WEG SA, Nidec Corporation, Rockwell Automation Inc., Schneider Electric, General Electric, and Mitsubishi Electric Corporation, among others.

These companies focus on innovation, digital integration, energy efficiency, and strategic partnerships to strengthen market presence.

6. How are energy efficiency regulations impacting the market?

Global regulatory frameworks are pushing industries to adopt high-efficiency motors classified under IE3 and IE4 standards. These motors reduce energy consumption, lower operational costs, and help companies comply with sustainability and carbon-reduction targets.

7. What are the key challenges in the Industrial Motor Market?

Major restraints include:

-

High initial investment costs for advanced motor systems

-

Raw material price volatility

-

Supply chain disruptions

-

Integration complexities in retrofitting older industrial systems

-

Shortage of skilled technical professionals in emerging markets

8. Which end-use industries generate the highest demand?

Key end-use industries include:

-

Oil & Gas

-

Power Generation

-

Water & Wastewater

-

Chemicals & Petrochemicals

-

Mining

-

Automotive

-

HVAC

-

Construction

-

Food & Beverage

Among these, manufacturing, energy, and automotive sectors account for substantial revenue contribution.

9. What technological trends are shaping the future of the market?

Emerging trends include:

-

IoT-enabled motor monitoring systems

-

Predictive maintenance integration

-

Smart motors compatible with automation platforms

-

Growth in medium- and high-voltage motors

-

Integration with renewable energy systems

Digitalization and AI-driven diagnostics are expected to further transform the competitive landscape.

10. What is the forecast period covered in the report?

The report includes:

-

Historical analysis: 2017–2024

-

Base year: 2025

-

Forecast period: 2026–2035

It provides detailed quantitative and qualitative analysis, including market size, CAGR, regional outlook, segmentation, and competitive landscape.

Our Latest Publication

Industrial Motor Market 2026-2035

Our Latest News:

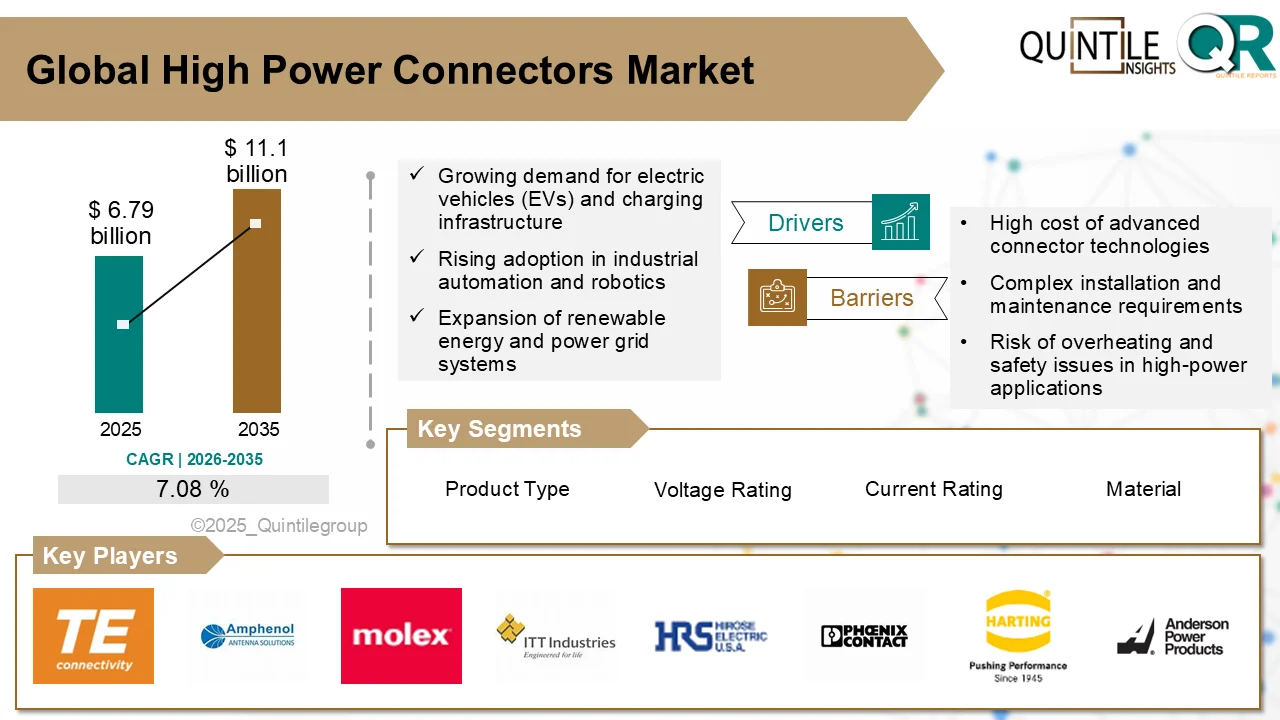

High Power Connectors Market to Reach USD 11.1 Billion by 2035 Amid Electrification Surge

Adarsh

Business Strategy — Quintile Reports

Adarsh is a Business Strategy professional focused on transforming market insights into actionable growth plans. He supports strategic initiatives through market analysis, competitive intelligence, and data-driven decision-making to help drive long-term business success.

His core skills include strategic planning, market research, growth opportunity assessment, trend analysis, performance tracking, stakeholder communication, cross-functional collaboration, and critical problem-solving.